Training and dedication are used by the best traders to develop their talents. Traders also conduct self-analysis to see the motive behind their trades and how to get rid of fear and greed from the picture. These are important skills that any forex trader that wants to be successful should develop.

However, forex trading is not as simple as you may believe. You can understand how difficult it might be to trade as a beginner who has only recently started utilizing regulated binary options brokers. Over the years, Forex has resulted in significant losses for many unskilled, impatient, and ill-disciplined traders. But you don’t have to be a loser.

You can’t deny the fact that trading could be complicated, even experienced traders will attest to that. You must get to know yourself in the forex trading market situation before you go.

You’ve taken the initial steps toward understanding the fundamentals of FX trading as a novice. But things are just going to get more difficult from here. You must take baby steps, just as you would when learning to walk, and you will fall in between, but you will get back up and continue forward.

If you’re new to forex trading, bear in mind that most novice traders benefit from keeping things simple.

This article will provide you with some essential forex hacks, tips, and approaches for a more sophisticated understanding of trading. Here are some trading strategies to help you avoid mistakes and optimize your profits in the currency market.

- Get to know yourself

To begin, carefully define your risk tolerance and have a thorough understanding of your requirements.

To make money as a forex trader, you must first learn how to spot the markets – but most importantly, you must learn to recognize yourself. The very first step to getting to know yourself is to make sure that your risk tolerance to forex and stock trading is not excessive, or inadequate. This means that before investing in forex trading, you must thoroughly research and analyze your financial objectives.

It’s critical to set specific objectives and be certain that your trading strategy can help you achieve them. Each forex trading style has the risk profile that comes with it, which also necessitates a specific mindset and approach to trade successfully.

- Make a strategy and stick to it.

You’re the most logical before trade and the most illogical during it. This is why you should always have a strategy in place before starting a new trade. Developing a trading strategy is a crucial part of being an excellent trader.

A trading plan is a methodical technique to implement a trading system that you’ve established based on your market research and perspective, as well as risk management and self-psychology.

You can tell if you’re on the correct track if you have a trading plan. You’ll have a means for evaluating the success rate that you can track over time. You may trade with less stress and emotion as a result of this.

- Select the account type and leverage ratio that you want to use.

You must select the account type that best meets your needs and expertise level. Although the many types of accounts provided by metatrader4 brokers can be perplexing at first, the basic rule is that lesser leverage is better. A regular account will suffice if you have a good grasp of leverage and trading. If you’re a complete newbie, you should use a demo account to study and practice for some time.

- Start with small amounts and gradually build the size of your account through organic growth rather than larger deposits.

One of the best forex trading strategies is to start with small amounts and minimal leverage, gradually increasing your account as earnings accrue. There is no evidence to support the notion that a larger account will result in greater revenues. If you can raise the value of your account through investing, that’s fantastic. If that’s the case, it’s pointless to keep feeding money into an account that’s consuming cash like a wildfire.

- Try Day Trading

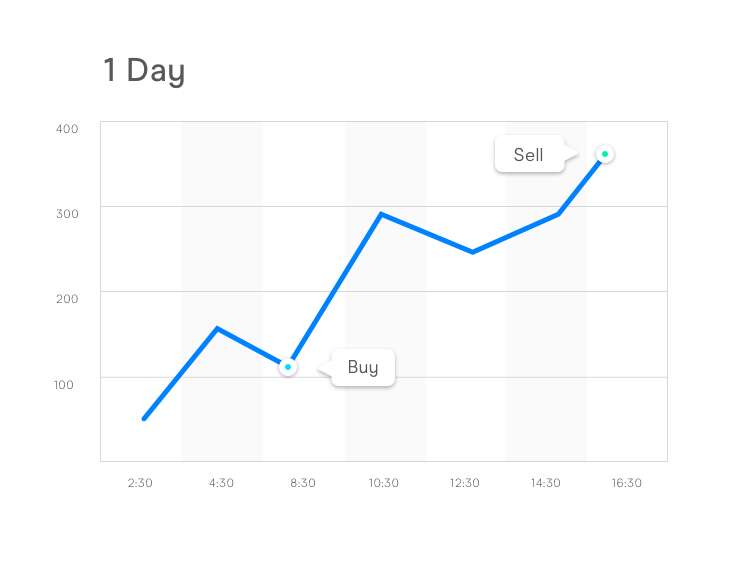

There are several shorter-term investment opportunities in the Forex market due to the enormous number of global deals, as well as their high sensitivity to incidents and different market linkages. If you want to respond to the market volatility in a short term, possibly for some hours rather than a long time, a Day Trading strategy may be right for you.

In general, day traders will recognize market trends and attitudes then trade in the same manner until they approach a support or resistance level. Their trade will be closed after their profit target has been attained or their stop-loss order has been activated. Day trading can be a great technique for trading the markets that necessitates a comprehensive risk management plan, time to react to fast-moving changes in the market, and a deep knowledge of your marketing environment.

- Maximize support and resistance strategy

Understanding how to use the resistance and support trading strategy is one of the most useful methods for trading Forex, and it’s also one of the simplest.

So, what exactly is the resistance and support trading strategy, and how can they assist you in your Forex trading?

A support level is a price below which a currency falls or comes to a halt as market or trading volume picks up again. Resistance levels, on the other hand, reflect a significant price level at which the market believes a currency is overrated, and they could be a clear indicator of a possible purchase shortly.

Both support and resistance levels can help you identify huge market entry and exit opportunities as part of your Forex trading strategy.

There is a wide range of tools available to assist you to discover crucial support and resistance levels in your preferred Forex market. You can use indicators like Bollinger Bands, RSI, and MACD, as well as your indicators, to determine critical market levels to analyze and trade.

- Do not quit.

Finally, as long as you only invest what you can manage to lose, perseverance and a desire to achieve are valuable assets. It’s impossible that you’ll become a trading mastermind suddenly, therefore it’s best to wait for your abilities to mature and your talents to blossom before quitting. The learning process will be harmless as long as the quantities you risk do not ruin your future ambitions or your life in general.