Since the emergence of decentralized finance, decentralized exchanges have become a predominant element in the crypto ecosystem. Many DEXes are operated on different Blockchains, Solana being by far the best known.

Several DEXs exist on the Solana blockchain, each with their own set of features and benefits. This article will review some of the best Solana DEXs and explain what they have to offer. Let’s go!

1. Raydium

Raydium is a DeFi application that powers DeFi expansion by acting as an AMM (automatic market maker) on-chain order book. Unlike several existing AMM platforms, Raydium offers on-chain access to a centralized limit order book. This implies that Raydium users and liquidity pools have access to the entire order flow and liquidity of the Serum ecosystem, and vice versa.

On Raydium, liquidity providers can earn trading fee incentives in return for their contributions. As farming rewards, RAY tokens are used to reward key pools. Additional reward tokens can be added by projects that want to reward users for providing liquidity.

Remarkably, as the platform grows, it intends to collaborate with other DeFi and AMM groups and provide support for their products to be built on Solana. As a result, additional liquidity will be introduced and new DeFi protocols will be introduced into the Solana ecosystem. Raydium will be able to provide more flexibility and functionality for future updates and new features with these additions.

Read also: How to buy Bitcoin(BTC)? The Best Sites in 2022

Features of Raydium

- Order Book: Raydium gives Order Books to AMMs through the influence of Serum. Raydium uses Serum’s liquidity to provide clients with the ability to place limit orders, market orders and other types of orders.

- Raydium DEX: Raydium, like other AMMs, allows market participants to trade using the liquidity provided by its own pools. The goal of Raydium DEX is to facilitate the exchange of lightly traded items. This feature allows users to switch tokens without using order books, while saving money on gas and trading fees.

- Pool: Liquidity providers will be allowed to receive benefits for liquidity contribution, just like other AMMs. RAY tokens will be used to reward key pools. Raydium has released permission less pools, giving everyone the ability to build tradable AMM pools. Considering this, leaving the pool without permission will be extremely beneficial for the Raydium community.

- Farm: Raydium farms are liquidity pools that allow liquidity providers to earn RAY tokens in addition to the trading costs they provide to the pool as farming incentives.

- Staking: Staking is a simple way to earn more RAY Tokens if you own RAY Tokens.

- AcceleRaytor: AcceleRaytor is a tool for new Solana businesses to raise funds and generate cash quickly.

- Dropzone: Raydium’s attempt to encourage the expansion of NFTs on Solana while providing project teams with the tools they need to launch new collections.

Raydium Staking

If you own RAY Tokens, staking is a simple method to make more. Aside from the essential responsibilities of swapping and liquidity provision. Users can earn RAY tokens by staking single assets or numerous LP tokens in Raydium’s Farms or Fusion Pools. RAY can also be staked on the site for further profit. The annual percentage return on staking RAY is currently 19.19 percent.

How are APY and predicted earnings measured?

The fees collected by the pool in the last 24 hours are extrapolated to a 365-day year, then divided by total liquidity in the pool yielding the APY from fees.

Raydium fees

When you make a swap on Raydium, you will be charged a 0.25 percent trading fee.

If you’re a liquidity provider on the platform, you’ll get a 0.22 percent trading fee incentive, with 0.03 percent going to those who stake RAY.

You don’t have to think about transaction costs on the Solana network. It’s insignificant.

RAY token

The native RAY token on Raydium Exchange is used for the following:

- The governance vote is used to make protocol decisions

- Staking for DEX Initial Offering Allocation Release

- Staking for protocol fee revenue

2. Serum

Serum is a decentralized exchange that allows users to buy cryptocurrency. Serum exchange is housed in its frame. When you need to trade cryptocurrencies, Serum comes into play as it offers the fastest speeds and lowest transaction prices to complement its previously established model. Anyone who wishes to participate in the program can do so for free on Solana.

Sam Bankman-Fried started the FTX crypto derivatives community. A bitcoin entrepreneur who featured in the Forbes 500 just over a year ago. Serum has already garnered interest from over 100 projects, including DeFi and Web, making it the most comprehensive blockchain to date. day. Serum offers some notable advantages over existing blockchains such as Ethereum and Chainlink.

The serum, on the other hand, is far from ideal. At the moment, the network only lists 15 tokens with their corresponding pairs, lagging behind many other exchanges. Only the most important cryptocurrencies, such as Bitcoin, Ethereum, Raydium and Chainlink, are included in the list of tokens.

What are the difficulties that Serum is trying to solve?

Serum was created to address the centralized failings of the current DeFi universe:

- Speed and convenience: DeFi is inefficient and expensive. A transaction costs dollars and takes a few minutes. To bring DeFi closer to users, it needs to be simpler and cheaper to use. Customers demand fast, low-cost exchange execution, where they can transact in seconds for less than financial institutions, without having to watch their wallets, wait for a deal to be confirmed, or miss opportunities.

- Centralization: To acquire data sources, most DeFi projects rely on centralized oracles. The main disadvantage of centralized oracles is that they are controlled by a single party and serve as a single source of data for smart contracts. They require contract participants to have a high level of self-confidence. As a result, centralized oracles could become tainted and vulnerable to manipulation. Users, on the other hand, demand genuine DeFi. Only a few options are available in the market.

- Stablecoins: USDT, USDC and other similar tokens are fantastic ideas. However, they are entirely backed by reserves, which are essentially bank deposits.

- Order Books: Users can trade using their trading pools with Dexes currently available in the market. AMM, on the other hand, has several drawbacks. There are no orders, offers or limited offers; users can only provide liquidity if they provide both parties. As a result, users cannot buy or sell at any price other than the current market price. Users need limited orders to try to protect their investments.

- Cross-chain support: Third-party services, which are identical to centralized systems, are usually required for cross-chain interaction between chains. For consumers to have access to pure DeFi, the ability of multiple decentralized networks to communicate with each other without the use of intermediaries should be required.

Serum Fees

Serum is supposed to offer extremely low trading fees, and the Serum Token (SRM) can be used to gain a 60 percent reduction on those fees.

Staking Rewards

For each transaction, the owner will receive 15% of the total reward for the node, with the other 85% shared equally.

On its assets, every node will earn a base APY of 2 percent per year, and a further 0% – 13% per year dependent on how successfully it fulfils its responsibilities.

Each node may also be rewarded for completing particular challenges and responsibilities.

Some actions may necessitate the posting of collateral by nodes. You potentially lose your collateral if the node performs badly.

SRM token

The Serum cryptocurrency is the utility coin of the Serum ecosystem. Serum is accessible on the Ethereum blockchain as well as the Solana blockchain.

MSRM token

MSRM tokens are Solana’s native ERC-20 coins and adhere to the SPL token protocol

SRM should include the following features:

Burn Activities: All total Serum charges go to an SRM burn.

Transaction fees: SRM can be used to pay fees. Owning SRM entitles you to a 50% discount on all serum charges. An MSRM entitles you to a 60% discount on fees.

Governance: A restricted governance system based on the SRM coin should be included in Serum. While the majority of the Serum ecosystem will be immutable, some settings with low security risks (such as future fees) may be changed by a vote on SRM token governance.

Staking rewards: A node can also be staked with SRM. Each node must contain a minimum of 10,000,000 SRMs and at least one MSRM. SRM will be issued as staking incentives to each node from a pool of SRMs.

3. Bonfida

Bonfida is a new network emerging from the Serum and Solana ecosystem. The platform provides a comprehensive product set that facilitates communication between Solana, Serum and its consumers. Bonfida’s API, which is used by some of the major market makers in the region and has seen a tremendous growth rate over its existence, also provides data analytics to Solana.

Why is Bonfida built on Serum?

A DEX order book should be fast. The underlying blockchain must meet certain standards for the platform to be responsive. The Bonfida Group chose Solana and its DEX serum as the basis of its efforts for a variety of reasons.

- High transaction throughput – Solana is capable of processing over 50,000 transactions per second. As the chain grows, this will increase much more.

- Lower Gas Costs – Per operation, the cost of gas is less than $0.001 on average.

- Composability – Because the Serum protocol is open-source, anyone in the community can contribute improvements that will benefit the ecosystem.

- Decentralization – Transactions and storage of crypto assets are fully decentralized and unaffected by other parties.

Characteristics of Bonfida

Exclusive markets and listing

Bonfida has access to Serum’s exclusive markets. Holders of the FIDA token have the opportunity to vote on the announcements that will be featured on the platform. AMM engages with companies like Alameda Research to provide liquidity.

Advanced order types on the blockchain

Limit and market orders are now accessible on Serum, while Bonfida is working on other features such as take-profit and stop-loss. Advanced on/off chain order types, on the other hand, will require users to stake their $FIDA.

TradingView charts are used to place orders

TradingView charts will be linked to on-chain data on Bonfida for the first time, and users will be able to place orders through them.

Advanced and basic user interface

Bonfida will offer two trading options for Serum, one for beginners and one for expert traders. “Bonfida Bots” and the aforementioned advanced command types will be available in advanced mode.

disponibles en mode avancé.

FIDA Staking

FIDA staking was first offered off-chain on AscendEX, with a set AP of 4%. After a few days, however, on-chain staking was discontinued. On-chain $FIDA staking, on the other hand, began in April 2022, and on-chain stakers receive airdropped 10% of the monthly buy and burn. It was decided to transfer all staking on-chain for the sake of decentralization.

Staking Rewards

Staking incentives will be earned by the staking contract as a percentage of the daily network fees earned by all network protocols.

Lockin Period

Staked tokens are held in the staking contract for a minimum of 365 days (1 year) and a maximum of 1,095 days (3 years). The period of time a wallet locks its staked tokens and the wallet’s earned rewards will remain locked before being released for usage by the wallet holder will have an inverse connection. Earned incentives will become claimable by the wallet holder in 365 days (1 year) from the day they were earned if tokens are locked for a minimum of 7 days. Earned incentives will become claimable on the day they are received if the tokens are locked for a maximum of three years. Between the maximum and minimum periods, a wallet holder can stake at any time.

IFAD token

Bonfida’s native utility cryptocurrency is FIDA. It is mainly used to pay for gas expenses of the platform, but it can also be used for the following.

- Access to VIP API

- Payments by robots

- Consulting services (for those who want to get into serum)

4. Orcas

ORCA is a decentralized exchange with its own pool of liquidity managed by an AMM. Orca allows traders to trade coins, and crypto fans and supporters can form their own Orca liquidity pools.

Orca is one of Solana’s most successful projects, taking advantage of the natural advantages of the network. Fast sub-second trades are possible on the exchange, and gas fees are less than $0.00002. To reward LPs, the exchange pays the liquidity pool 0.3% of the trading fee.

Orca Features

For cryptocurrency investors and traders, Orca has three main features:

- Token Swaps: Orca allows users to trade tokens using DEX liquidity pools.

- Liquidity pools: LPs can contribute to the pools in exchange for a share of swap trading fees.

- Yield Farming: LPs will be able to earn trading fees and ORCA tokens by joining some of Orca’s liquidity pools, which will become Aquafarm. In the years to come, other projects may add their tokens.

Orca staking

You can earn $ORCA and a percentage of swap fees by providing liquidity on Aquafarms! You can use Orca to double your standard SOL staking yield by deploying your stSOL in any of the pools below.

- stSOL / wstETH – APR of 15.9%* (incentivised with 10,000 LDO per month)

- stSOL / wLDO – 4.05 percent APR*

- stSOL / USDC – 43.1% APR* (incentivised with 60,000 LDO per month)

ORCA can be staked for protocol income incentives via xORCA once you’ve accumulated some, regardless of how you got it. It’s important to note upfront that there are no costs associated with the staking/unstaking process with OrcaDAO.

xORCA Ratio

xORCA functions as an ORCA iterative ratio. When money is given to staked ORCA owners, the ratio of xORCA to ORCA will increase.

In other words, the more you stake your ORCA to xORCA, the higher your xORCA to ORCA ratio would be. This implies that when it’s time to unstake your xORCA back into ORCA, you’ll get your portion back for free, plus the extra ORCA that staking incentives have supplied.

Because revenue is distributed every 48 hours, your xORCA to ORCA ratio will improve every 48 hours.

ORCA token

Utility: as compensation for the opportunity cost of donating funds or the risk of transient loss, liquidity providers receive a portion of the fee.

Governance: Currently, liquidity providers receive 0.3% of all trades on product pools. Following the issuance of the governance token, the distribution will be modified as follows:

- 0.25% for liquidity providers

- 0.04% for the Orca Treasure

- 0.01% for the Impact Fund

5. Saros

Saros Finance is a DeFi suite that includes several products, including SarosSwap, SarosFarm, and SarosStake, with SarosSwap serving as the core component. Other fundamental blocks will certainly emerge in the years to come.

Features of Saros

Saros Swap

SarosSwap is an AMM that uses the formula of price x times y equals k. Manufacturers can worry less about liquidity issues and focus more on product development by applying this basic methodology.

So how does SarosSwap differ from other AMMs on Solana? The team believes in two cutting-edge concepts: a hype-generating device to offer the best possible price and a gamification component to diversify the product.

Saros Farm

The early seeding of cash after project launch has been a big problem for Solana’s initiatives. They can recruit more sources of liquidity by organizing Liquidity Mining programs. Liquidity providers, on the other hand, are forced to search for these programs all the time because they cannot stay in one place.

Because SarosFarm is an aggregation solution for a variety of incentive pools, it overcomes this problem. Not only can projects grow simply and quickly with rich cash, but cash providers can also have an all-in-one platform for farming by employing SarosFarm.

Saros Game

SarosStake is a simple system that allows you to stake SAROS to earn more tokens. This feature is essential for backers who intend to hold the SAROS token for an extended period of time.

Users can stake SAROS tokens instead of leaving them idle in their wallet, earning a variety of rewards.

Saros Staking

On Saros Finance, SarosStake is the simplest way to earn free tokens. You simply need to stake SAROS and get free tokens while sleeping. It’s truly that simple. We’ll also have dedicated pools where you can stake coins other than SAROS!

SarosStake is a lot easier than SarosFarm because you only need to stake one token to start earning, which is usually SAROS.

Yield-farming offers excellent APYs in exchange for the risk of permanent loss. If you’re farming with SAROS-SOL, for example, you can miss out on possible gains if SAROS rises but SOL remains unchanged. It’s a high-risk, high-reward situation. Instead, stake your SAROS tokens to generate dividends with no impermanent loss (IL) and maximize your profits when SAROS prices rise. You don’t have to do anything but click the stake button for your rewards to compound.

SAROS Token

The SAROS currency is at the heart of the Saros Finance ecosystem. In exchange for their SAROS coins, token owners receive fees, governance rights, airdrops, and participation in gamification events. As of April 2022, this coin is no longer active.

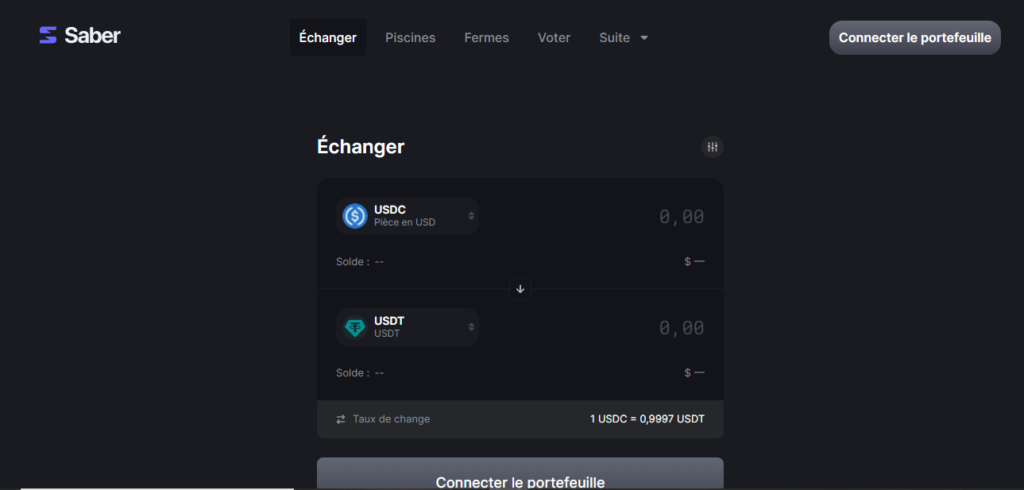

6. Saber

Saber is Solana’s primary cross-chain stablecoin platform, providing the underlying liquidity for stablecoins, which are cryptocurrencies whose value is tied to another asset.

Saber serves as Solana’s main cross-chain liquidity network, enabling the transfer of assets across Solana as well as other blockchains. Market makers place crypto in a Saber liquidity pool to earn passive income from transaction fees, token-based rewards, and ultimately automated DeFi tactics.

Saber, which is based on Solana, uses low spend and fast transaction settlements are two of the main features of Solana. When trading, users should expect little to no lag.

Saber Labs received a $7.7 million seed round. Race Capital led the round, which also included Coin98 Ventures, Jump Capital, Multicoin Capital, Chamath Palihapitiya’s Social Capital, and the Solana Foundation.

Saber Swapping

Saber has already made a name for itself in the market as a DEX with low fees. The fees for any coin pair swap are less than 1%.

Any two coins tied to the same asset can be swapped, whether they are fiat currency or large crypto like Bitcoin. Swapping between currencies tied to various assets, i.e. coins whose exchange rates aren’t always steady, isn’t possible.

Liquidity Pool Staking

In addition to cryptocurrency swaps, Saber also supports LP staking.By donating their funds to a pool of their choice on the platform, liquidity providers can receive a return. There are a total of 25 pools available right now.

The annual percentage yields from staking on Saber are enormous even by DeFi standards. These rates, however, may fluctuate dramatically over a short period of time, as is typical of yields on crypto trading platforms. As of this writing, yields of up to 64 percent are available. USDT-USDC, one of the largest and most commonly traded pools, offers a 27 percent payout.

SBR token

The SBR token has two main functionalities:

- Utility: SBR holders can be rewarded with SBR for providing liquidity to pools.

- Governance: SBR holders will be able to vote in the Saber DAO.

7. Mercurial Finance

Mercurial Finance creates the first dynamic vaults for stablecoin investments, offering low-slip swaps for digital currencies and currency pairs, enabling liquidity providers to increase LP profits by leveraging dynamic fees, and enabling users/communities to participate in decision-making through its DAO program.

Performance programs

Yield programs will manage the allocation of distributed assets to external platforms such as lending protocols to earn additional interest and returns. The collection of interest and returns is also part of this management.

The DAO must authorize these yield systems before the vault capital can be transferred to other networks. The DAO will also determine the percentage of deployable assets for each vault.

Flash loans, loan system security, and leveraged stable loans are all examples of external platform deployment. Platforms will be chosen based on rewards, risk profiles, and the ease with which liquidity can be retrieved.

New initiatives can be incorporated into current coffers to improve base capital income.

You can mitigate IL with Mercurial by pooling stSOL with SOL and gaining greater yield on your stSOL.

- stSOL / SOL – 2.49 percent annual percentage rate (MER rewards) + 4.18 percent annual percentage rate (APR) (incentivised with 40,000 LDO per month)

CAD program

The DAO will make important decisions such as:

- Fees and commissions: on swap and vault transactions.

- Use of fees: Whether the fees will be burned or distributed.

- Deployment destinations: Where capital can be deployed.

- Maximum LTV: Maximum amount of capital that can be deployed externally per vault.

SEA token

The MER token will be used in two main possibilities:

Utility

- Utility: The Mercurial protocol is designed to provide a diverse set of mechanisms for MER holders to earn value.

- Exchange fees: MER token holders will receive a percentage of the exchange fee and also benefit from transactions such as buying and burning MER tokens.

- Commission: MER holders will receive commissions based on the interest and yield of the vault.

- Collateral for synthetic stables: MER tokens can be used as collateral for minting synthetic and other stables by MER token holders.

Governance

- Governance: Key features such as exchange fees, tactics used to improve vault revenue, etc. will be governed by MER holders.

- Voting on collateral for synthetic stables: New synthetic stable assets and new types of collateral will be voted on by MER holders.

- Liquidity rewards: Liquidity providers and participants are rewarded with MER tokens.

- Insurance pool: MER tokens could be used as a form of insurance to cover losses incurred due to the extreme volatility of indexed assets.

Conclusion

Solana is currently one of the most advanced blockchains in the bitcoin market. It is home to a number of fantastic decentralized exchanges. Solana DEXs make decentralized finance more accessible to traders using market research methodologies, higher liquidity, price indicators, stablecoin exchanges and improved graphical user interfaces have further increased their popularity.

The success of Solana projects pushed the price of SOL to a new all-time high in November 2021. Solana’s profitability attracts new dApp developers to the network every day, expanding its ecosystem and strengthening the entire Solana community.