USD Coin is the Stablecoin that is pegged by US dollars and it is introduced on Ethereum Blockchain. USDC is the coin that tokenizes US Dollars and facilitates their use over the internet and public blockchains. It is one of the most popular cryptocurrencies. It hits 18th place in the list of top cryptocurrencies in terms of market capitalization. It is listed on several crypto exchanges. Top crypto exchanges are listing USDC after seeing the popularity of this coin.

This article is devoted to USDC tokens. Here we will cover all the important aspects of USDC tokens.

Also read: How to buy Binance (BNB) Coin?- Guide

What is USD Coin?

USD Coin is the Stablecoin that is pegged by US Dollar. It is a fully collateralized Stablecoin that is issued on the Ethereum blockchain, it is also called Ethereum powered coin. USDC is an open-source coin that is traded over a decentralized network. In the list of the top twenty cryptocurrencies of the world, USDC stands at 18th number. It was first introduced in the market on September 26, 2018, in collaboration with Circle and Coinbase. USDC is also introduced as an alternative to other USD-backed cryptocurrencies like Tether (USDT) or TrueUSD (TUSD).

It is listed on several crypto exchanges. Top crypto exchanges are listing USDC after seeing the popularity of this coin. USDC is the coin that tokenizes US Dollars and facilitates their use over the internet and public blockchains. USDC tokens can be redeemed at any time whenever the user wants.The operations of issuing and redeeming USDC tokens are executed through ERC-20 smart contract.

USDC tokens are created with the purpose to introduce US dollars on blockchain as blockchain allows the coins to travel anywhere in the world. This brings stability to cryptocurrencies. It has launched new opportunities for trading, lending, and more in the market.

Founders of USD Coin

USD Coin is founded by the Centre consortium, a partnership between Circle and Coinbase. The technology and governance were created by the Centre. Circle and Coinbase are the first commercial issuers of USDC.

The circle was founded in 2013 by the entrepreneurs Jeremy Allaire and Sean Neville. The circle is the official money transmitter that makes the company an open financial book. Money transmitters are US money service businesses that comply with all Federal laws and regulations. Circle has accredited an equivalent amount of USD to accredited partners before the issuance of USDC. All USDC tokens are regulated, transparent, and provable. The circle is a renowned crypto startup that is backed by Goldman Sachs.

How does USD Coin work?

USD Coins aren’t just printed money, it is a digital currency. Circle guarantees that every USDC token is backed by a single US Dollar. The process of converting US dollars into USDC tokens is called tokenization.

Tokenizing USD into USDC is a three-step process-

- A user sends USD to the token issuer’s bank account.

- The issuer uses a USDC smart contract to create an equivalent amount of USDC.

- The newly minted USDC is delivered to the user while the US dollar is kept in reserve.

To redeem USDC for USD is very easy just like mining the token.

- A user sends the request to the USDC issuer to redeem the USD for equivalent USDC tokens.

- The issuer sends the request to the USDC smart contract to exchange the tokens for USD and pick the equivalent amount of tokens out of circulation.

- The issuer sends the requested amount of USD from the reserves back to the bank account of the user. The user will receive the net amount equivalent to the one in the USDC token minus all incurred fees.

How to use USD Coin?

USD Coin (USDC) is the 1:1 representation of one US dollar on the blockchain; this means one USD is issued for one US dollar. USD coin is an ERC-20 token and it can be used with every application that supports the standard.

To tokenize the USDC with Circle you are needed to register the account first then verify your identity & complete the KYC, after this provide the bank details. Circle USD platform performs all the core actions-

- Tokenize USD

- Redeem USDC

- Transfer USDC out to ERC20 compatible Ethereum addresses

- Deposit USDC from external Ethereum wallet addresses

Circle USDC doesn’t impose any fees for tokenizing and redeeming the USD coins. It charges only $50 commission for incorrect and rejected bank transfers. Coinbase imposes fees on all the operations and the standard fees are applied to it.

How is USD Coin different from other Stablecoins?

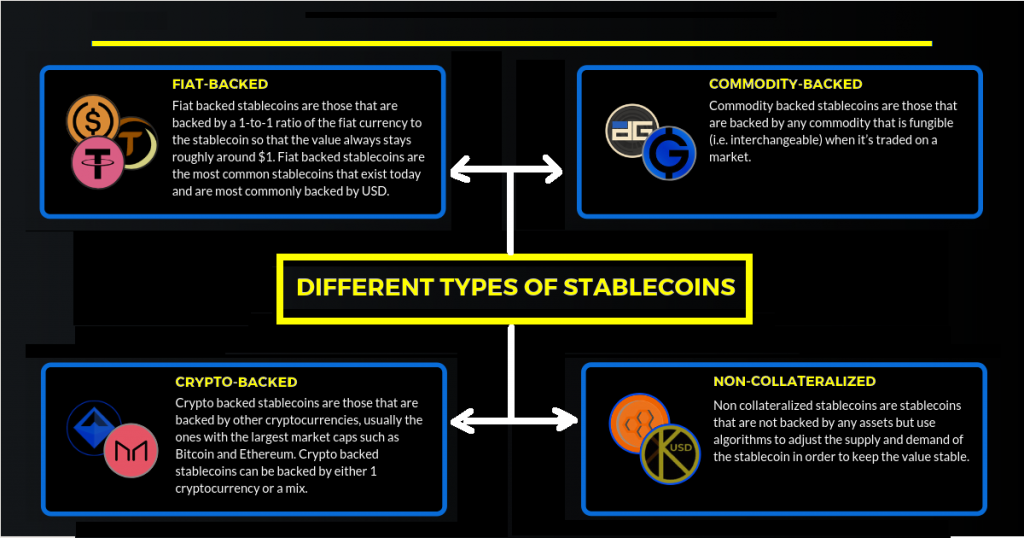

Crypto Stablecoins are categorized into four sections-

- Fiat-collateral- Fiat-collateral currencies are those Stablecoins that are tokenized in coins and it is reserved the fiat value. All the fiat collateral coins are centralized by design. Tether (USDT), TrueUSD (TUSD), Gemini Dollar (GUSD), Paxos Standard Token (PAX), Digix Gold (DGX), and USD Coin (USDC).

- Crypto-collateral- Crypto-collateral currencies are those Stablecoins whole value is reserved in crypto assets. Makercoin (MKR& DAI) and Havven (nUSD& HAV) are Crypto-collateral currencies.

- Algorithmic non-collateral- Algorithmic non-collateral coins are software-based economic models that provide price stability without any collateralized assets. Basis, Kawala, and Fragments are Algorithmic non-collateral coins.

- Hybrid- Hybrid Stablecoins are the coins that rely on a blend of Fiat-collateral, Crypto-collateral, and algorithmic non-collateral coins. Carbon is an example of this category.

USD coins come in the first category that is known as Fiat-collateralized currencies. It is referred to as centralized Stablecoin. Those coins that come in this category work similarly in the same way as others. The value of Digix Gold is reserved for gold.

Where to buy USD coin?

You can buy USD coins on any exchange. Several exchanges offer USDC-

- Binance (Paired with BTC, BNB)

- Coinbase Pro (Paired with BTC, ETH)

- Coinbase (Paired with BTC, ETH)

- Poloniex ( Paired with BTC, ETH, XRP, BCH, STR, LTC, ZEC, XMR, DOGE)

- CoinEx (Paired with USDT)

- Coinsuper (Paired with BTC, USD)

- OKEx (Paired with BTC, USDT)

- CPDAX (Paired with BTC)

- Hotbit (Paired with USDT)

- Kucoin (Paired with BTC, ETH, USDT)

- Korbit (Paired with KRW)

- Fcoin (Paired with USDT)

- Crex24 (paired with USD)

Where to store USDC?

USDC is the ERC-20 token that is issued on the Ethereum blockchain and it can be stored in the Ethereum wallet. It is advised to store the coins in digital wallets. A digital wallet is an electronic wallet that stores crypto assets. You can store the USD coins in MyEtherWallet, MetaMask, and Mint. Choose the wallet that supports USD coins.

How to buy USDC tokens?

Buy USDC via fiat money on Coinbase

For US residents, the easiest way of buying USD coin is via Coinbase. It is very simple to buy USDC here, follow these steps and you will get USDC.

- First Log in to the Coinbase account if you have no account on Coinbase.

- Go to the USDC page on the Coinbase site

- Go to the right side of the page where you have to enter the amount you wish to buy USDC tokens.

- Select the payment method from the options available.

- Click Preview Purchase

- Confirm the purchase order by clicking on “Buy Now”.

Buy USD by trading crypto

USD Coin is supported on almost all top crypto exchanges where you trade in other top currencies like Bitcoin, Ethereum. On these exchanges, you can trade in pairs of Bitcoin and Ethereum for USD coins at the best rates in the market.

For non-US residents, Binance is the best cryptocurrency exchange for buy USDC tokens.

How to buy USDC tokens on Binance?

Following are the steps to follow for buying USDC tokens on Binance exchange-

- Register for an account on Binance exchange

- Verify your identity

- Select the USDC tokens from available coins

- Open the payment portal and enter the amount

- Select the payment method from the options available

- Confirm the order

- Click on “Buy Now” to complete the transaction

Which blockchain network hosts USDC?

USDC tokens are introduced on Ethereum Blockchain. It is a fully collateralized Stablecoin that is issued on the Ethereum blockchain.

How many USD coins are in circulation?

There are 14.38B USDC tokens are in circulation in the market. In the list of the top twenty cryptocurrencies of the world, USDC stands at 18th number. In terms of market capitalization, it is standing at the eighteenth number in the market. The total market capitalization of USDC is recorded at $14,382,366,437.

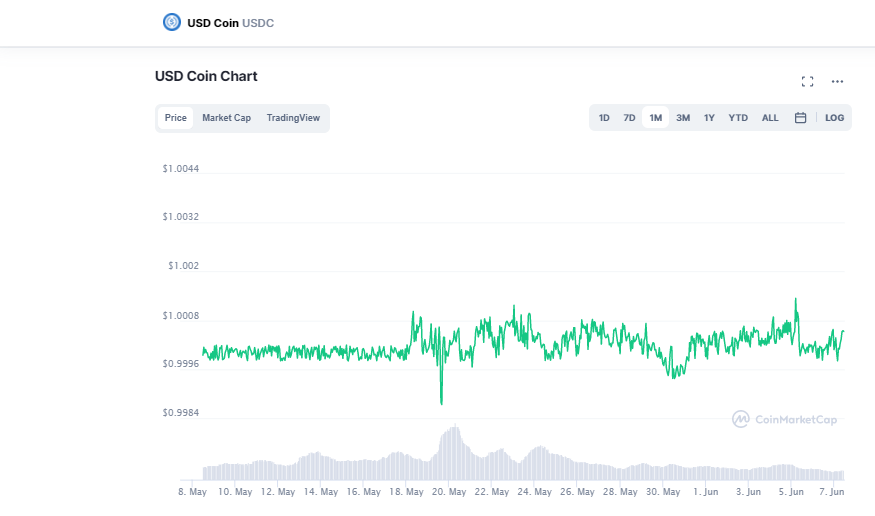

The current state of USDC in the market

USDC is a rapidly growing project and it is getting successful day by day in the market. Behind the success of this project, it is the hand of credible institutions. This project was firstly introduced in 2008 and since then it is getting pace in the market. Currently, there are 60 partners in this project. The prices of USDC were recorded at $0.9998.